It’s amazing how much value is being created from intangible digital goods. NBA Topshot is a recent example of this intangible revolution. A blockchain-based platform allowing fans to buy, sell and trade digital ‘moments’.

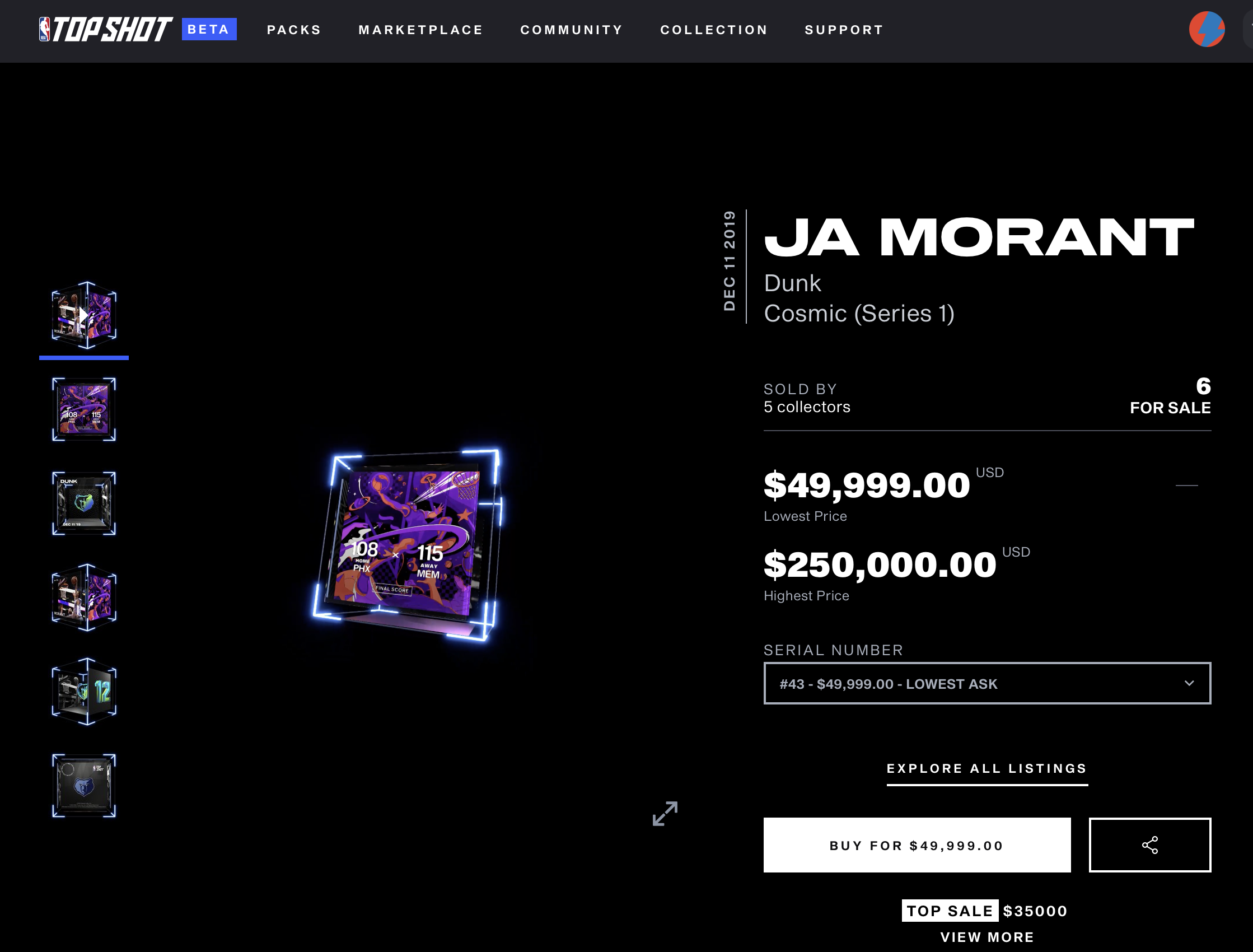

Moments can range from $2 to $250,000. Crazy for something that is still in Beta. What lessons Private Equity can take from NBA Topshot’s successes and failures?

There are three things NBA Topshot has nailed.

1) Using the lessons learnt from years of successful physical card trading

Numbered editions, common editions, coloured variants and even misprints.

2) A clever pricing structure for packs and an open market rule for moments

Alongside moments, you can buy ‘packs’ from $9. Like a real life pack of trading cards you never know what you will get.

3) Using social media to build credibility and a fear of missing out.

Getting Mark Cuban hooked increased sales last week by 30%. In particular for Maxi Kleber moments.

But, there are three areas where NBA Topshot has failed.

1) Sometimes you can’t access NBA Topshot due to site instability

They can’t cope with the demand of their users and have resorted to live stress tests. Testing on your users is a bad tactic in any book.

(Remind you of anyone? https://themarkethill.com/robin-hood-w/)

2) Right now ‘packs’ are impossible to get hold of

This lack of packs is upsetting the economics of the market. Common moments see price surges only to decrease when more are released to meet demand.

3) Competing run, grow, scale, fix priorities

They have a small dev team. With Open tickets, instability, feature requests and surges of new users. Will they have to press pause on the Beta, or can they recover?

https://blog.nbatopshot.com/posts/state-of-nba-topshot

There are some warning signs you can look for in your portfolio companies.

Are you teams focused on building new features or fighting open tickets?

How do users lets you know they are happy/unhappy? With their wallets or social media?

Are you reinventing the wheel each time or improving on what’s been done before?

NBA Topshot is one example of an intangible, crypto product.

It won’t be long before these types of products and platforms become common place in your portfolio. What will you do next?

Thomas

You can sign up for more ‘unconsidered needs’ below.

Sign up for more ‘unconsidered needs’ below.